Institutions in Continuing Education

Commented Data on:

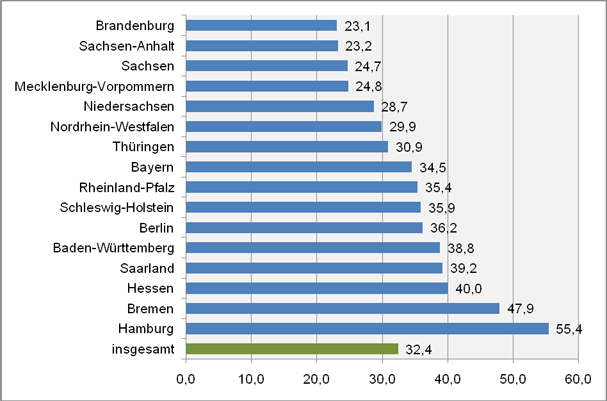

Provider Density in Federal States (2008)

To establish the basic entity of continuing educational providers in Germany, data of institutionalized or operational institutions that offer continuing education as a main or additional task regularly or periodically was collected in the cooperation project “Provider Research“ conducted by the Federal Institute for Vocational Education and Training (BIBB), the German Institute for Adult Education (DIE) and the Institute for Development Planning and Structural Research (IES). The majority of providers are located in Baden-Wurttemberg, Bavaria and North Rhine-Westphalia. Proportional to the number of inhabitants, the city states of Bremen and Hamburg have the highest density of providers whereas the density in the northern states in general, with the exception of Schleswig-Holstein, is lower than in the southern states (see table 1). It varies between 55.4 providers per 100,000 inhabitants in Hamburg and 23.1 providers in Brandenburg. The average density is 32.4 providers per 100,000 inhabitants.

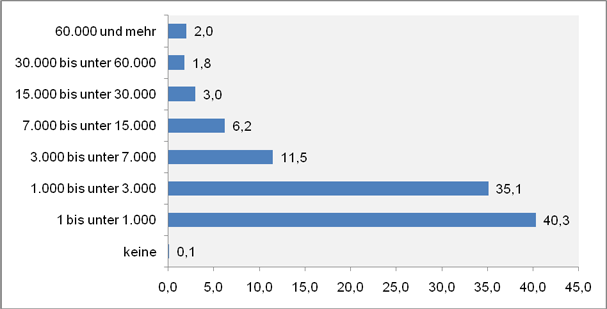

Size of Providers Listed by Lesson Volume (2008)

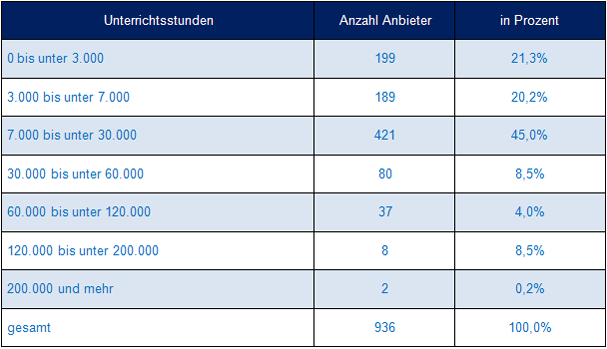

A multitude of differently sized institutions offer continuing education in Germany. The findings of the cooperation project “Provider Research“ conducted by the Federal Institute for Vocational Education and Training (BIBB), the German Institute for Adult Education (DIE) and the Institute for Development Planning and Structural Research (IES) give an overview of the providers‘ sizes. Number and structural data of institutions that offer open programmes in Germany as a main or additional task. Based on the lesson volume, the majority of these institutions are “small” (see table 2). 75 percent of the participating institutions conduct up to 3,000 lessons annually, 40 percent conduct less than 1,000 lessons. Four percent of the providers are “larger“ institutions conducting more than 30,000 lessons. Two percent of all institutions conduct 60,000 and more lessons annually.

Based on the lesson volume, adult education centres are generally small institutions (see table 1). 87 percent of adult education centres conduct 30,000 or less lessons annually. 20 percent of the adult education centres conduct up to 3,000 lessons. Only as little as one percent of adult education centres are big institutions and conduct more than 120,000 lessons.

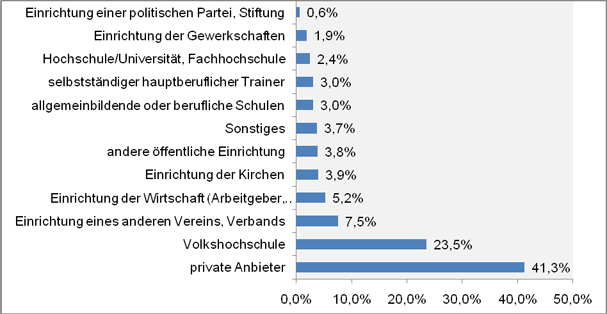

Provider Spectre Listed by Type of Institution (2008)

The cooperation project “Provider Research“ conducted by the Federal Institute for Vocational Education and Training (BIBB), the German Institute for Adult Education (DIE) and the Institute for Development Planning and Structural Research (IES) collected information about the number and structural data of institutions that provide open continuing educational programmes in Germany as a main or additional task. Based on the carrier, the institutions were categorized in line with the system used in the Adult Education Survey. 41.3 percent of all providers are private institutions, followed by adult education centres that cover nearly a quarter of all providers (23.5%). Other associations are in third place (7.5%). Business institutions cover about 5 percent, whereas all the other providers cover less than four percent.

Requested Provider of Continuing Education Programmes (2007)

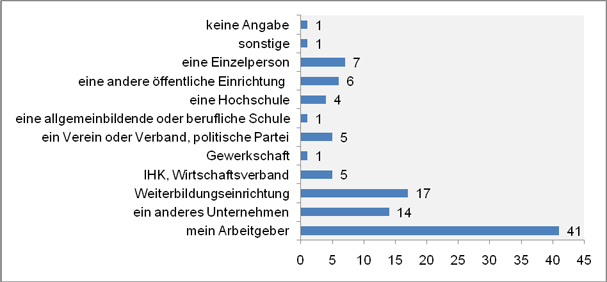

The Adult Education Survey (AES) as well as the project “Provider Research” (table 3) provide an insight of the institutional structure of the German market of continuing education and training. The percentage distribution of participation in programmes offered by various providers indicates that employers were the biggest provider of continuing education and training (41%) in 2007 (see table 4). Followed by continuing educational institutions (17%), other businesses (14%), individuals (7%) and other public institutions (6%). The other providers cover 5 percent or less.

Distribution of Participation (1991 – 2003)

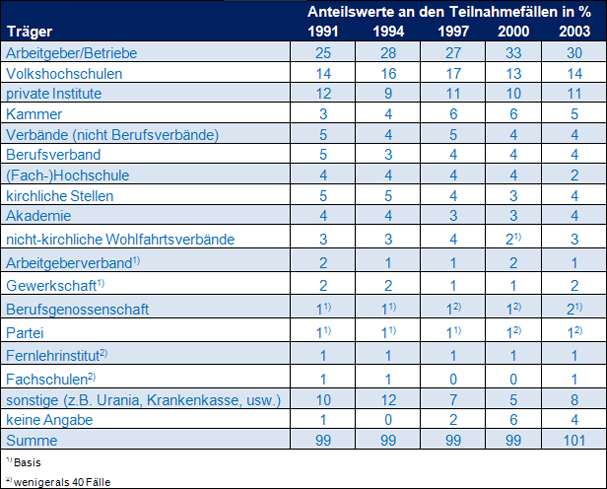

Based on the indicator “Participation”, the Reporting System on Continuing Education and Training (Berichtssystems Weiterbildung - BSW) provides information on the carrier structure in German continuing education (see table. 6). In 2003, the biggest group of carriers is the group of employers and businesses which cover nearly a third of all participation. Runner- up is the group of adult education centres (14%), followed by private institutions (11%). Chambers are the fourth biggest carrier group (5%), followed by associations (not including professional associations), professional associations, church institutions and academies (4%). The other carrier groups cover 3 percent or less. Since 1991, apart from a slight decrease since 2000, the percentage of employers and businesses has continuously increased. The percentage of all other carriers has only varied slightly during that period. The carrier structure with regard to participation has been relatively stable since 1991.

Economic Climate of Providers of Continuing Education (2007-2010)

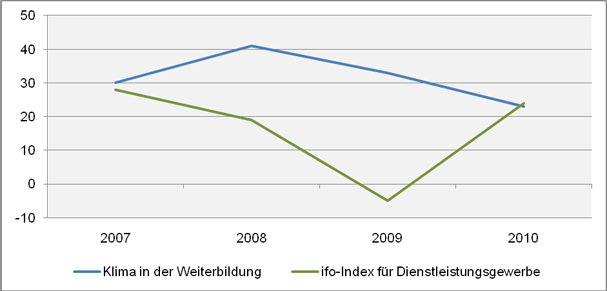

Based on the annual provider survey “wbmonitor“ conducted by the Federal Institute for Vocational Education and Training (Bundesinstitut für Berufsbildung - BIBB) and the German Institute for Adult Education (DIE), the climate index is an indicator for the economic mood in the field of continuing education and training. Following the Ifo Business Climate Index, the wbmonitor climate index is an average of the differences of positive respectively negative estimates of the current and future economic situation. The estimates are weighted according to the number of lessons conducted by the providers during the previous year. The index may vary -100 and +100; higher values indicate a better mood. In 2008, the climate index of continuing education reached 41 points; by far more than the 2007 value (+27) (see table 5). Following the to-date peak level, the index has decreased steadily. In 2009 it was lower than the year before with 33 points; in contrast to 2010, it decreased by ten points to +23. Not all providers of continuing education and training are similarly affected by the decreasing economic mood. Different developments are obvious within the provider spectrum (see table 3: Economic Climate of Selected Sub-Groups).

Economic Climate of Selected Sub-Groups (2007-2010)

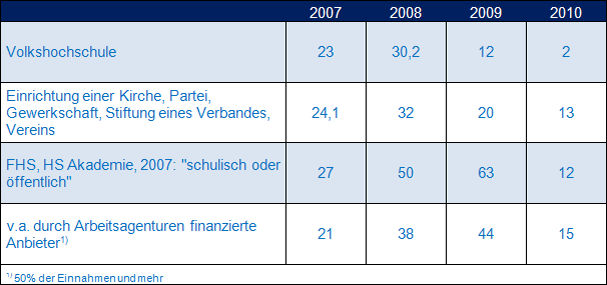

Based on the annual provider survey “wbmonitor“ conducted by the Federal Institute for Vocational Education and Training (Bundesinstitut für Berufsbildung - BIBB) and the German Institute for Adult Education (DIE), the climate index is an indicator for the economic mood in the field of continuing education and training. After a high level in 2008, the period between 2007 und 2010 reveals an increasingly pessimistic estimation of the economic situation in the field of continuing education. The individual mood depends mostly on the type of institution (see table 3). Particularly adult education centres are affected by the downward trend; following the to-date peak level of 30 points in 2008, the climate index decreases to 2 points in 2010. After a three year period of a positive mood, institutions of scientific further education and providers, which are mostly financed by public employment services, are affected by the significant decline of the climate index.

Kurzlink zu dieser Seite:

die-bonn.de/li/1226